Understanding Form 3520: Avoid Tax Penalty through Accurate Foreign Asset Reporting

Over the past decade, the IRS has intensified scrutiny on foreign asset reporting, with non-compliance leading to severe tax penalty implications, including hefty fines and criminal charges for U.S. taxpayers. Though we have already discussed at length the FBAR and Form 8938, this article will take a deeper dive into one of the most common international information reporting forms - Form 3520.

Who is Required to Report?

- U.S. taxpayers are obliged under tax law to report global income. "United States Persons" who must report include:

- U.S. citizens or residents

- Domestic partnerships and corporations

- U.S. estates (excluding foreign ones)

- Trusts under U.S. jurisdiction

- Others not classified as "foreign persons".

"Foreign persons" encompass non-U.S. residents, foreign corporations, partnerships, trusts, estates, and others not identified as U.S. persons.

Risk of Non-Compliance

U.S. Persons with foreign assets may be subject to filling out multiple forms, including Form 3520, during a tax year. Mistakes or failure to comply can invite significant tax penalties.

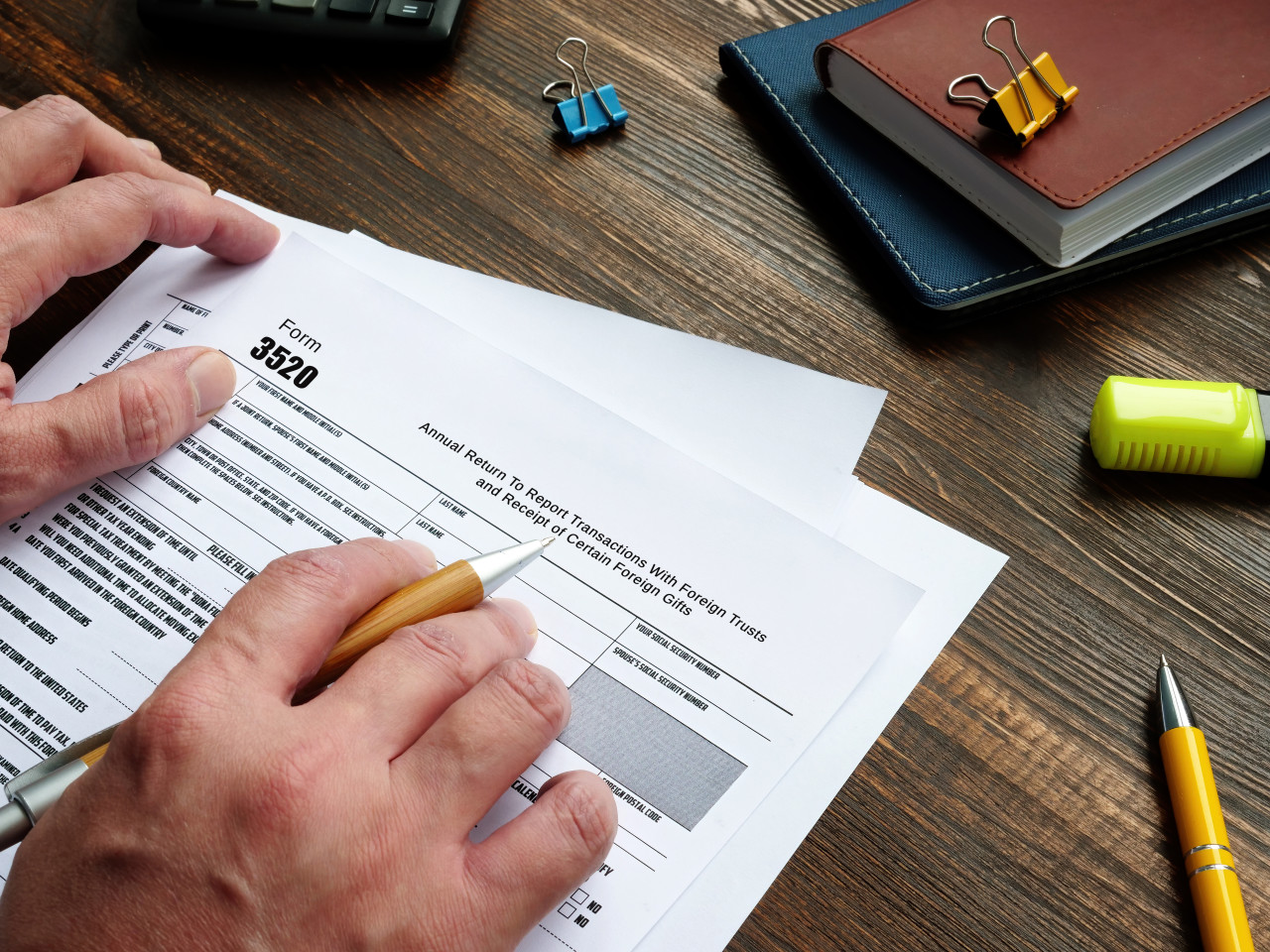

Form 3520 Explained

Form 3520, titled “Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts”, is crucial for U.S. Persons and those managing estates of deceased U.S. citizens. It is used to report:

- Transactions with foreign trusts

- Ownership of foreign trusts as outlined in specific tax rules

- Receipt of substantial gifts or bequests from certain foreign entities

Who Should File Form 3520?

Filing Form 3520 is mandatory if:

- Engaged in notable transactions with foreign trusts

- Ownership of a portion of foreign trust assets in the current tax year per specific tax rules

- Receipt of large gifts amounting to over $100,000 from foreign individuals or estates, or over $16,649 from foreign corporations or partnerships.

Filing Details

Form 3520 is typically due on April 15th but can be extended to October 15th if necessary. It must be meticulously completed to avoid being considered unfilled, which may result in tax penalties.

Consequences of Late or Erroneous Filing

Late or incorrect filing of Form 3520 can result in a tax penalty. Penalties begin at $10,000 or 35% of the reported amount, escalating if errors are not corrected promptly upon notification by the IRS.

Need Professional Assistance?

If foreign trusts or substantial foreign gifts are involved, it is prudent to seek professional assistance to navigate the intricate tax law. Engaging a proficient tax attorney in The Woodlands can be invaluable. For residents in Houston, consulting with a seasoned tax attorney in Houston is advisable for expert help with taxes and to mitigate risks associated with tax evasion. With the experienced guidance of tax lawyers from The Wilson Firm, you can adeptly handle offshore voluntary disclosures, understanding and complying with the nuanced requirements of Form 3520, thereby avoiding potential pitfalls and penalties.